Project Expenditure Business Unit Data Securityĭata security role to access PPM Project Expenditure business unit based data.ĭata security based on the Projects that the Project Manager is assigned.ĭata security role to access fixed asset book based data.ĭata security role to access Projects Contract business unit based data. Procurement Requisition Business Unit Data Securityĭata security role to access procurement Requisition business unit based data.ĭata security role to access PPM Project business unit based data.ĭata security role to access PPM Project Organization hierarchy based data. Procurement Inventory Organization Data Securityĭata security role to access Receipts subject area basis the receiving organization. OA4F_PPM_PROJECTS_CONTRACTS_BUSINESS_UNIT_DATAĪccounts Payable Business Unit Data Securityĭata security role to access accounts payable business unit based data.ĭata security role to access procurement business unit based data. OAX_PROC_PURCHASE_AGREEMENT_ANALYSIS_DUTY OA4F_FIN_EXM_EMPLOYEE_EXPENSE_ANALYSIS_DUTY Special considerations, tips, and things to look out for in using the subject area to create analyses and reports. The lowest transactional data grain determines how data are joined in a report. The lowest grain of transactional data in a subject area. With a few exceptions, all dimensional data are current as of the primary transaction dates or system date. Historical reporting refers to reporting on historical transactional data in a subject area. Time reporting considerations in using the subject area, such as whether the subject area reports historical data or only the current data. Primary navigation to the work area that is represented by the subject area. Job-specific groups and duty roles that can be used to secure access to the subjectĪrea, with a link to more detailed information about each job role and duty The information for each subject area includes:īusiness questions that can be answered by data in the subject area, with a link to more detailed information about each business question. These subject areas, with their corresponding data, are available for you to use when creating and editing analyses and reports.

For example, clickĢ2.R3_Aug2022_Fusion_ERP_Analytics_SubjectAreas.html. Once the file downloads, extract the file, open the folder, and then open the

AP TURNOVER DAYS ZIP FILE

Knowing your accounts payable turnover is an easy way to manage your vouchers, analyze your payments, and maintain supplier relations.Download this ZIP file that contains available subject area information that appliesįusion ERP Analytics. A new supplier may ask for your accounts payable turnover ratio before they agree to do business with you so they know when you’re likely to pay your bills. If the ratio is decreasing over time, you’re paying your suppliers more slowly. In general, it’s best to calculate your accounts payable turnover ratio for multiple periods and compare your results. Although this typically means you have a strong cash flow, it could also mean you are not efficiently using creditor terms or are paying suppliers too soon. A higher turnover calculation means you are paying your current debts faster. In the example above, your average account payable for the year would be outstanding for 18.25 days. You can also divide the number of days in a period by your accounts payable turnover to find out the number of days your payables were outstanding. If you have total supplier purchases of $100,000 for the year and an average accounts payable balance of $5,000, your accounts payable turnover is 20.

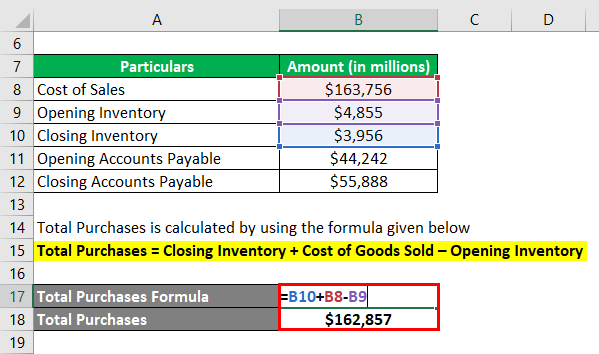

The turnover tells you how many times in a period you pay your average accounts payable balance. You can calculate your accounts payable turnover by dividing the total cost of sales by the average balance in accounts payable.

Your accounts payable turnover is the rate you pay your bills.

0 kommentar(er)

0 kommentar(er)